Banks

Regulatory-compliant identity verification for banks

Whether a traditional bank or a FinTech: Elevate your processes to Nect Level speed and compliance with the Money Laundering Act. With fast identity verification tailored to your needs.

Know Your Customer

Preventing fraud through identity verification

Do you know your customers? Be proactive and actively prevent fraud with our patented identity verification. Automated Video Ident, online ID function, or international passport: Always identify your customers according to regulatory requirements.

Tailored Trust Services

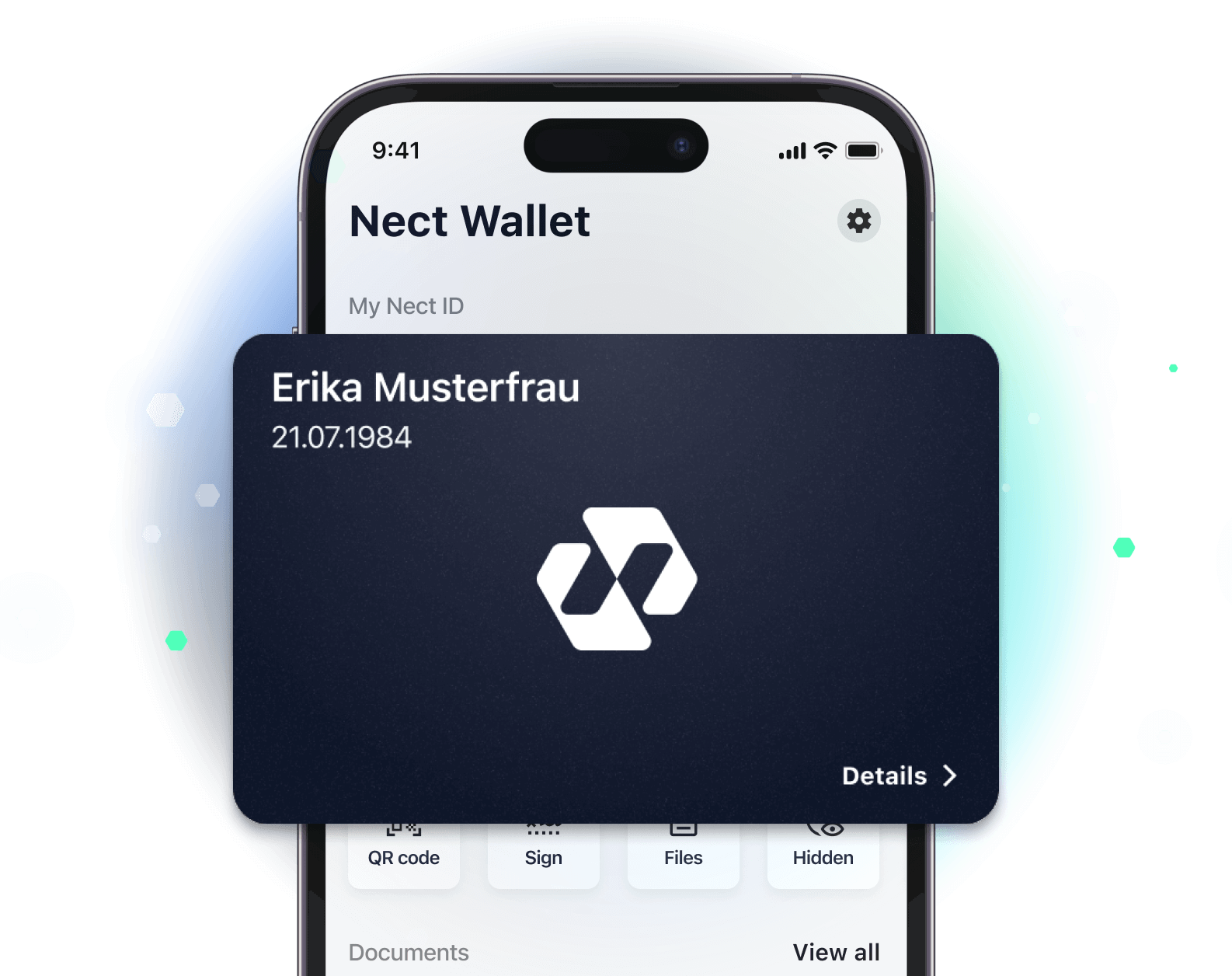

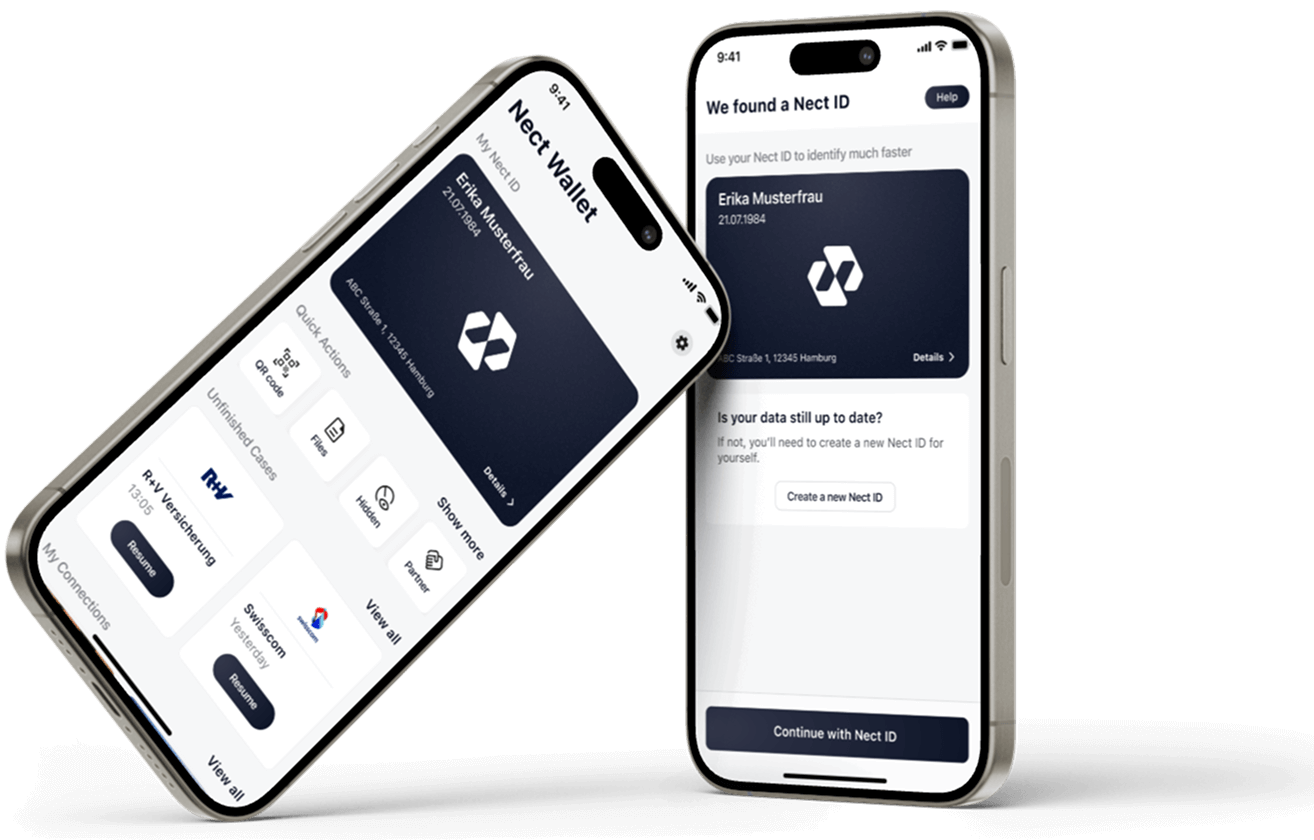

Banking with Nect

Save costs, make processes more efficient, and keep customers happy. Sounds good? With our certified technology, we create scalable solutions tailored to your needs. Whether for identification or signing, whether for AML-regulated processes or other use cases, our solutions are secure, fast, and simple.

Account Openings

Replacement for activation and PIN letters

Initial Verifications

Fraud prevention before disbursement of payments

Custody Account Openings

Qualified Electronic Signature, e.g., for consumer loan agreements and guarantees

With eID for AML Compliance

Online identification for banks is tied to a variety of regulations and requirements, including §13 of the Money Laundering Act (AML Act). Certain processes can therefore only be covered by procedures approved by BaFin, such as the electronic identity card (eID). These include:

Initial Verifications

Account Openings

Custody Account Openings

Thanks to the flexible identification methods within Nect Ident, you can also benefit from the advantages of our technology for these processes.

We integrate the AusweisIDent Online identification solution from D-Trust, a company of the Bundesdruckerei Group, into our process. The electronic function of the identity card (eID) is thus made usable in the Nect Wallet, and the AML regulations are thereby met.