Client due diligence for effective risk minimization

Comply with the Anti-Money Laundering Act: Fast, digital, and legally compliant

Reliably verify your clients – for individuals and companies to minimize risks

Features at a Glance

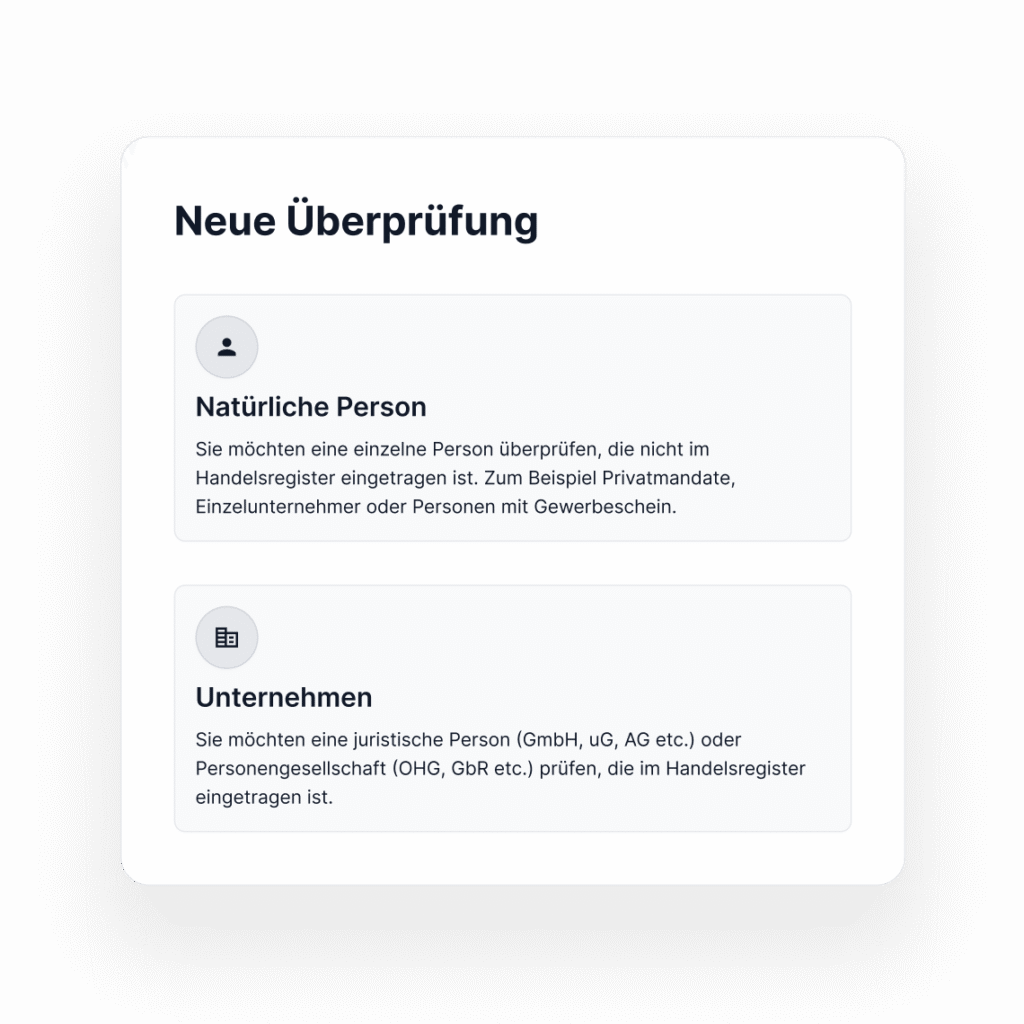

Verification of individuals and companies

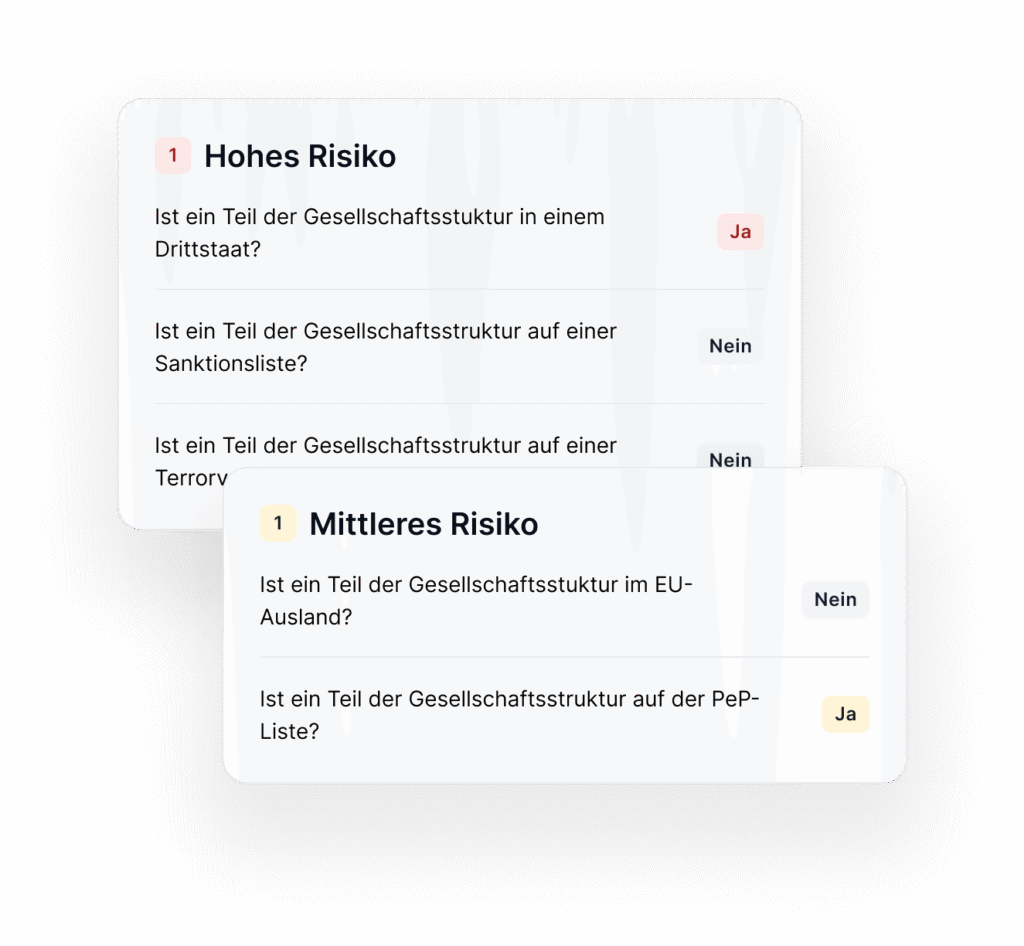

AI-powered risk profile

100% audit-proof AML report

Fully automated PEP, terror, and sanctions list screening

Continuous monitoring for potential risks

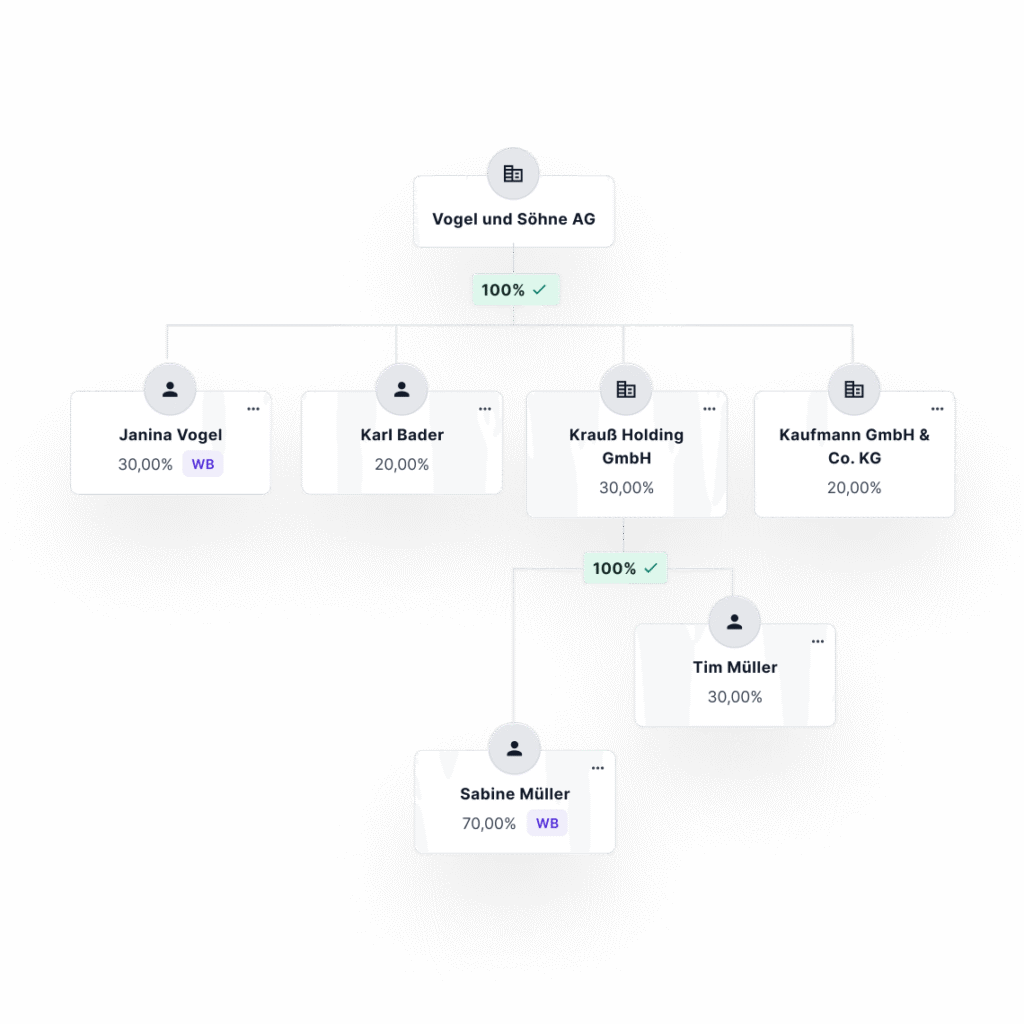

Creation of the ownership structure

Ident for over 150 different identification documents

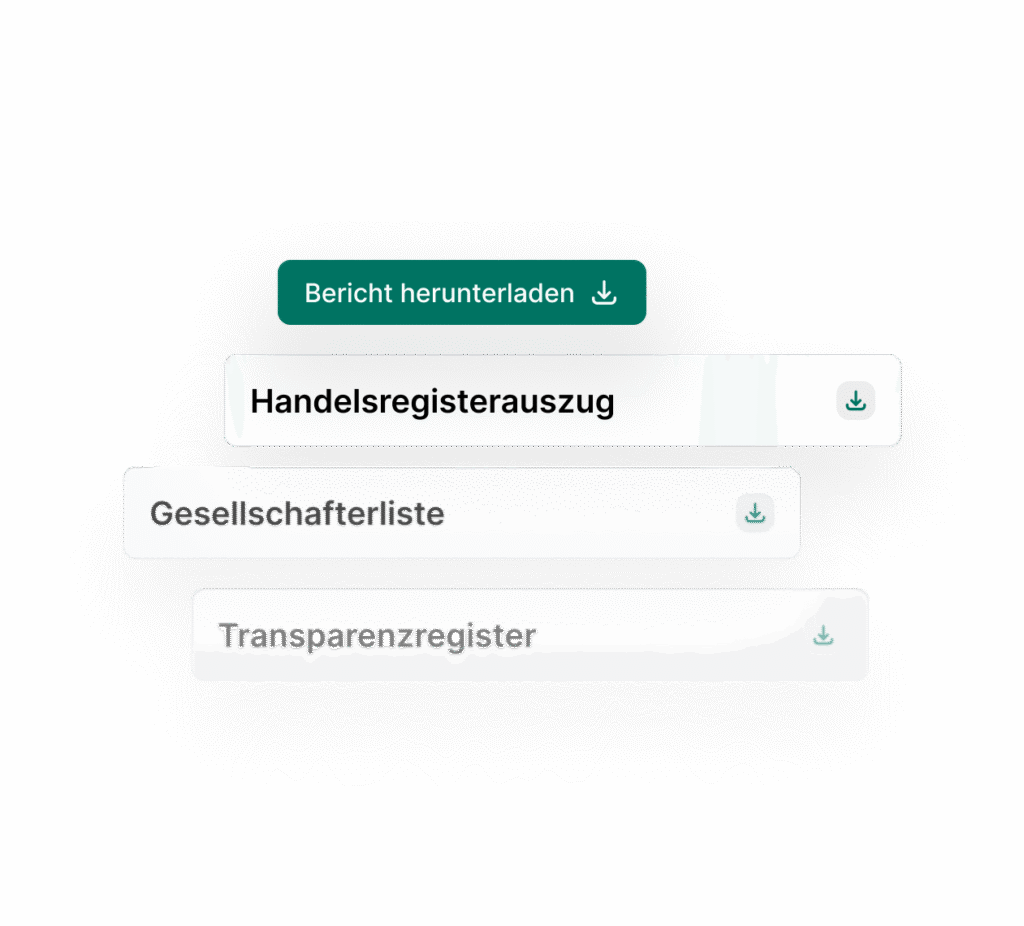

Fully automated register query for the Transparency Register, Commercial Register, and Shareholder List

Automatic determination of beneficial owners

Implement all AML requirements in just a few steps

Everything based on the already verified identity. Your Touchpoint in the Nect Wallet: You receive your own branded portal in our Nect Wallet, visible to over 13 million people

Create client & start new verification

Whether an individual or a company – we meet all legal requirements for every use case.

With fast integration and a complete overview of your entire client base.

Automatically pre-filled data for a fast workflow

Your client is automatically invited for identity verification.

Data verification and completion takes only a few minutes. The VideoIdent procedure is seamlessly integrated into the process in accordance with current standards.

Receive results report & assess risk

Finally, you will receive a comprehensive audit report.

This includes an AI-powered risk profile as well as the results of screenings against PEP, sanctions, and terror lists.

An automated reminder management system additionally ensures that no deadlines or follow-up checks are overlooked.

Download report for more details

Legally documented: Audit-proof report including all relevant register documents – supplemented by continuous monitoring and automatic re-checks.

Compliance, Sustainability, and Scalability.

Optimizing customer communication is a key lever for many companies in the insurance and financial sector to increase their efficiency and strengthen customer loyalty. With the Nect Box, we offer an innovative solution that transforms paper-based communication into a fully digital and automated experience.

Meet Compliance

Over 13 million verified identities in the app and 20,000 new users daily.

Sustainable and Future-Proof

Digital Delivery: No paper, no envelopes, less CO2.

Maximize Conversion Rates

No login required. No media break. Just consent - and you're good to go.

Reduce Losses & Lower Costs

Up to 70% cheaper than paper mail

Improve Security & Data Protection

Deemed Delivery, eIDAS-compliant, Archiving Possible

Use cases

The right solution for every industry

We offer obliged entities under the Anti-Money Laundering Act a straightforward and efficient way to meet their AML compliance requirements. Our solution automates and digitizes the due diligence of natural and legal persons for groups of obliged entities such as lawyers, notaries, tax advisors, or real estate agents, and offers AI-powered risk analyses as well as secure client management. This enables users to implement AML compliance efficiently, legally securely, and in a data protection-compliant manner.